use cases for a commercial-off-the-shelf reference CBDC solution which proposes CBDC architecture as Digital Financial Market Infrastructure (DFMI)

The key is CBDC as digital cash doesn’t change physical cash essential properties (especially, its usage in legal tender process with legal finality of cash payments).

CBDC as digital cash extends the physical cash with the full functionality of the internet.

CBDC as digital cash is an enabler for free-of-charge, instantaneous, unconditional transfer with legal finality of value between any two parties; anytime, anywhere, without censorship. This will enable digital transformation of local economies, financial markets and investment practices. Lesser barriers in time, distance, legality, etc. improve the entire global economic position of all of the earth’s peoples.

All use cases can be used in various combinations depending on the particular situation.

For example, for countries with a financial and economic crisis, we recommend the following:

- Provide liquidity via digital national currency as legal tender;

- Revive local economy via local area digital currency;

- Enable cross-border payments in national currencies via supra-national gold-based digital currency.

The CBDC is a means of free, instant, unconditional and legal finality transfer of “tangible value” between any two parties; anytime, anywhere and uncensored. This creates the basis for Digital Transformation (DT) of the local economy, financial markets and investment practices.

Lack of barriers in time, distance, legality, etc. will improve the economic situation of all peoples of the Earth.

All use cases can be used in various combinations depending on the specific situation.

For example, for countries with financial and economic crisis, we recommend the following:

- Provide liquidity through the digital national currency as legal tender;

- Issue special versions of the digital national currency to finance “big people’s construction projects” with a legal traceability of its use (to reduce the level of corruption);

- Revitalize the local economy with local digital currency;

- Create the possibility of cross-border payments in national currencies through a supranational digital currency based on gold.

Outline of the commercial-off-the-shelf reference CBDC solution

The main features of this CBDC reference solution are given in the table below as a comparison of the physical cash features.

| № | Characteristic | Physical cash property | Reference CBDC solution* property |

| 1 | input to legal tender function | YES | YES |

| 2 | legal finality of transactions | YES | YES |

| 3 | no interest | YES | YES |

| 4 | bearer financial instrument | YES | YES |

| 5 | central bank direct claim | YES | YES |

| 6 | anonymous | YES | YES** |

| 7 | censorship-free | YES | YES |

| 8 | zero translation fees | YES | YES |

| 9 | accessible | YES | YES*** |

| 10 | autonomous payment | YES | YES*** |

| 11 | instantaneous payment | YES | YES |

| 12 | retail payments | YES | YES |

| 13 | RTGS payments | NO | YES**** |

| 14 | cross-border payments | NO | YES***** |

| 15 | payment in the same place | mandatory | anywhere |

| 16 | payment at the same time | mandatory | anytime |

| 17 | risk to be stolen | high | low |

| 18 | risk to be lost | medium | low |

| 19 | risk to be counterfeited | high | zero |

| 20 | ALM conformance | low | high |

| 21 | ALM support | NO | YES |

| 22 | programmable | NO | YES****** |

| 23 | face value | fixed | flexible |

| 24 | cost of minting | high | zero |

| 25 | cost of burning | high | zero |

| 26 | cost of maintenance | high | low |

| 27 | public good | YES | YES |

| 28 | nature of money | Fiat | Fiat |

| 29 | parity to M0 (cash in circulation) | 1:1 | 1:1 |

| 30 | parity to M1-M0 (CB reserves) | NO | via free market or 1:1 |

| 31 | parity to M2-M1 (banks deposits) | 1:1 limited | via free market or 1:1 |

| 32 | parity to M3-M2 | NO | via free market or 1:1 |

| 33 | provenance of money | Public | Public |

* Proof-of-Concept (PoC) testing is available

** disclose is possible under a court decision

*** different applications to implement accessibility and autonomy can be developed on top of the CBDC infrastructure

**** no RTGS systems are necessary

***** an international version of CBDC is necessary

****** (programmable is considered as linking money-generated events with some actions executed by code) via APIs and events of the CBDC infrastructure

Infrastructure style architecture

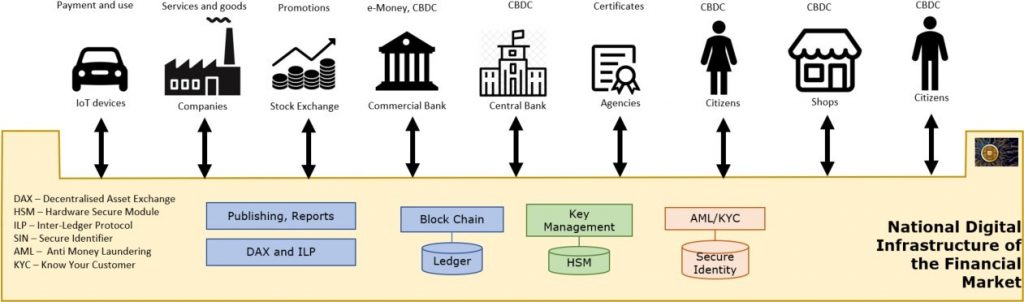

This reference CBDC solution is implemented as an infrastructure which is actually, Digital Financial Market Infrastructure (DFMI). This DFMI covers the majority of typical CBDC requirements. Some country-specific requirements can be implemented via API. It is considered that each country employs its own national copy of this DFMI. If a country is not happy with some aspects of the reference CBDC solution then the country can extend and customize without breaking underlying principles of the DFMI. Thus the national DFMIs are naturally integrated as the international (global) DFMI. Hence this architecture provides CBDC interoperability by design.

The out-of-the-box capabilities of the reference CBDC solution, in addition to CBDC, allows the following:

- payments, initiated by IoT devices;

- other legally codified digital financial bearer assets, such as securities, and;

- certificates for supply-chains.

All CBDC stakeholders interact with the DFMI as shown below.

|

Please note, that although CBDC as digital cash change rate vs physical cash is 1:1, money of commercial banks (e-money on the illustration above) can be also be exchanged vs CBDC but at a free market rate. It is considered that such national DFMI is operated by a private company, chosen by the Central Bank.

Ideally, national DMFI is a treated as a public good and some DFMI use cases are provided by the private companies in partnership with the Central bank.

retail CBDC

This use cases is rather straightforward. The seller (Shop) sends an invoice to the buyer (Citizen) who executes the requested payment.

Cross-border payments in national currencies with national CBDC

Cross-border payments require the introduction of an additional supranational currency that is pegged to gold.

Benefits for participants of using digital cash (CBDC) instead of physical cash:

- No censorship and less hassle

- Free-of-charge payments enable small transactions and low-margin transactions

Benefits for participants of using digital cash (CBDC) instead of other methods:

- Immediate payments

- Final legality of payments

- Free-of-charge payments eliminate $200 B per year overhead

- Free-of-charge payments enable small transactions and low-margin transactions

Cross-border payments in national currencies without national CBDC

The DFMI may implement also cross-border payments without deploying national CBDC. This is a typical situation when a group of countries forms an economic (trade) association and wants to optimise payments between them. For this reason, an additional supra-nation digital currency should be created and distributed to several central banks. This currency is, some kind, a legal tender for central banks to streamline cross-border payments.

CBDC WITH PROTECTION AGAINST INTENDED USE

Some CBDC can be additionally labeled as issued to finance a major project.

Additional labeling makes it possible to track the use of these CBDC and thereby reduce the level of corruption.

PURCHASING SHARES ON THE STOCK EXCHANGE

If the shares are transferred to the digital, then the CBDC implements the standard version «Delivery vs Payment” (DvP)».

USE CASE “CERTIFICATES”

Legal certificates are can be represented as legally codified digital financial bearer assets.

retail CBDC

This use cases are rather straightforward. The seller (Shop) sends an invoice to the buyer (Citizen) who executes the requested payment.

Benefits for participants (seller and buyer) of using digital cash (CBDC) instead of physical cash:

- Different place (even world-wide)

- Faster (no change return)

- Safer (no carrying cash)

CROSS-BORDER PAYMENTS USING CBDC

Cross-border payments require the introduction of an additional supranational currency that is pegged to gold.

LOCAL CURRENCY TO SUPPORT THE LOCAL ECONOMY

City, territory, administrative division, etc. can create their digital local currency to support local producers of goods and services.

LOCAL CURRENCY FOR DIGITAL ASSETS CIRCULATION

The digital asset exchange can issue its own currency.

GUARANTEED INTEGRABILITY OF NATIONAL CBDC

Imagine that the leading international financial institutions (IMF, BIS, FATF, SEC, etc.) agree to adopt this architecture. Then the Financial Market Digital Infrastructure can be deployed in any country and guarantee the international compatibility of the CBDC.